It used to be that when the IRS discovered you’ve been claiming a child who is actually a 50-pound Labrador retriever named “Billy,” everyone would have a good laugh. Not any more. The Treasury Department says it will be cracking down on “aggressive tax deductions” filed by U.S. taxpayers in order to keep the federal government from being bilked out of hundreds of millions of dollars — money that could otherwise be spent on important federal programs, such as the Congressional Caribbean Getaway Fund.

It used to be that when the IRS discovered you’ve been claiming a child who is actually a 50-pound Labrador retriever named “Billy,” everyone would have a good laugh. Not any more. The Treasury Department says it will be cracking down on “aggressive tax deductions” filed by U.S. taxpayers in order to keep the federal government from being bilked out of hundreds of millions of dollars — money that could otherwise be spent on important federal programs, such as the Congressional Caribbean Getaway Fund.

As a service to readers, several of whom are actual U.S. taxpayers, I thought I’d contact some of the brightest minds in tax law in order to clarify what we can still get away with. Unfortunately, everyone was too busy working on the Clinton family’s tax returns to help. So, as aresponsible member of the news media, I was left with only one option:

Forget taxes! Let’s talk about who’s next on Dancing With The Stars!

Just kidding. I rolled up my sleeves. Got on the Internet. Made phone calls. And eventually came up with some real-life tax claims you should NOT make unless you want to end up in jail — or worse, on the computer screen of a humor columnist trying to meet a deadline.

Our first example comes from Raleigh, N.C., where a man with an unsuccessful furniture-store business did what any enterprising owner would do: hire an arsonist to burn it down.

After determining the fire was indeed the result of a three-piece sectional explosion which then spread to a spare gas can kept near the curtains display, the insurance company paid the owner $500,000. He then dutifully reported the amount on his tax return, which also included deductions for the loss of the building, its contents, as well as a “consulting fee” of $10,000 paid to the arsonist. It’s unclear whether the man actually used the term “arson consultant” on his return. The point is, if you’re going to burn down your business for the insurance money, don’t be stupid:

Do it in North Carolina.

Our next example involves an ostrich farmer from Louisiana, where apparently the state motto has been changed to:

We raise ostriches that could step on your state bird.

In this case, the farmer filed a claim for the depreciation of his ostrich which, as it turns out, is perfectly legal! In fact, you can claim the depreciation of any animal used for breeding.

However, it doesn’t mean that if “Buster” gets out and fraternizes with the neighbor’s cocker spaniel that you can claim him as a deduction.

Even if “Buster” happens to be an ostrich.

So what does all this mean to you and me, the average U.S. taxpayers? It means that if we want to claim ourselves as a tax deduction, we need to begin breeding immediately.

No. What it really means is that with tax day upon us, time is running out if you want to get “Billy” a social security card and claim him on your taxes. And if you begin to suspect that the IRS is catching on, do what one Wyoming CPA told his client to do and simply mark “Billy” as “deceased” on your next tax return. If they want to know what happened, just tell them the details are still sketchy.

All you know is that it involved a freak sofa explosion somewhere in North Carolina.

______________________________________________________________________________________

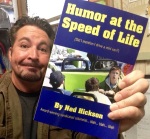

WARNING! This has been a shameless excerpt from my book, Humor at the Speed of Life, which is a collection of my most popular columns over the years (as opposed to the kind I usually write) and is available in hardcopy or eBook version at Port Hole Publications, Amazon.com or Barnes & Noble. It makes a great gift for Mother’s Day! (Note: results may vary). Order yours from Port Hole Publications and let them know you’d like a signed copy. It can even be signed by someone else!

WARNING! This has been a shameless excerpt from my book, Humor at the Speed of Life, which is a collection of my most popular columns over the years (as opposed to the kind I usually write) and is available in hardcopy or eBook version at Port Hole Publications, Amazon.com or Barnes & Noble. It makes a great gift for Mother’s Day! (Note: results may vary). Order yours from Port Hole Publications and let them know you’d like a signed copy. It can even be signed by someone else!

Bwahahaha! We have some odd tax laws here in Canada as well. For the Canadian who likes to gamble in the US, losses can be used as tax deductions against any winnings. There is an IRS form for Canadians to apply for a refund on US taxes paid on gambling wins if losses have been incurred. ha! Also, believe it or not, although polygamy is illegal in Canada, it is legal to claim multiple spouses on your income tax. Mind you living with multiple spouses ( is the plural of “spouse”, “spice” like the plural of mouse is mice?) could be problematic.

Funny post Ned. Thanks for the laugh.

Wow! But I suppose those Canadian tax laws on gambling and extra spouseses’ makes sense: Having multipe wives would definitely be considered a gamble.

So very crazy! I need to go buy me a breeding ostrich named Buster. Oh wait,maybe that wouldn’t fly (See what I did there) in Canada..

Lol! I generally just stick my head in the ground come tax time…

What else can one do?

damn it, ned! i’ve been wanting to claim the cost of my carpet spot remover in the place where nacho the cat puked red stuff with chunks all over my dove grey rug and it’s never been quite the same color. now kind of has a tie-dyed effect in that area and for the cost of my therapy and coffee and gas to get there to deal with it all

Beth… Beth… Beth… *sigh* Bring the carpet to North Carolina, burn it, THEN you can claim it!

I love tax time.

It’s fun to watch my accountant openly giggle/weep as he examines my earnings for the year…

Geez Hickson , did you have to let that nugget of info about North Carolina slip ? Now everyone will want to move here .

Sorry, Pamela — but if you see furniture stores popping up everywhere, now you’ll know why…